What Are the Basics of Cryptocurrency and Crypto Mining?

Cryptocurrency and crypto mining. Some people see them as the future of trading and exchanges, while others view them as enigmas. Love it or hate it, many people are drawn to this emerging asset class.

This is the industry that created a monetary system that circumvents today’s financial institutions. This is the industry that grew from cyberspace ether and then floated to a $3 trillion market capitalization in 2021.1 But this is also the industry that’s rife with controversy in regard to its cost, volatility and energy consumption – especially when it comes to crypto mining and trade.

What Exactly is Cryptocurrency?

Cryptocurrency is a decentralized form of digital money that can be used to purchase goods and services. There are roughly 19,000 different cryptocurrencies in circulation; the two most common cryptocurrencies are:

- Bitcoin: Designed as a form of digital money that bypasses control of government and financial institutions. Most investors today see it for its value as a form of “digital gold.”

- Ethereum: Built to maintain a decentralized payment network, but also powers decentralized software programs and applications.

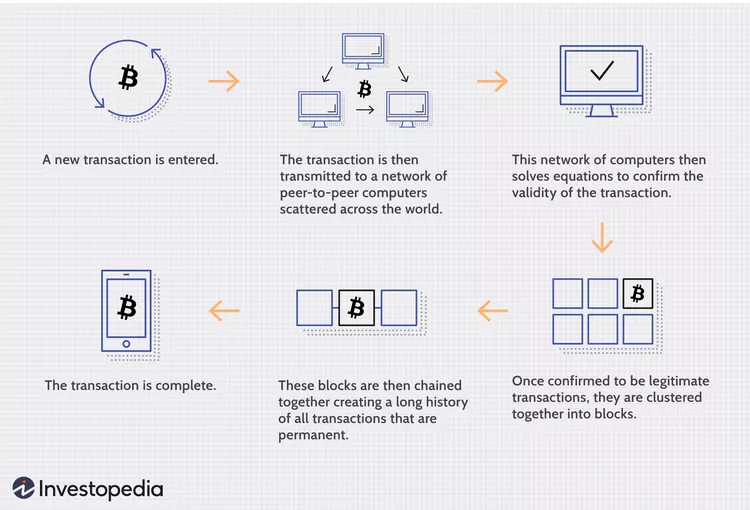

Other modern currencies rely on a central authority to manage and maintain value, whereas cryptocurrency distributes these tasks among online “miners.” Most cryptocurrencies are powered by blockchain, which is an open, distributed ledger of transactions shared across a network. Transactions are recorded in groups known as blocks, which hold sets of information. Each block is part of a virtual chain, and any new information is compiled into a newly formed block to be added to the chain. Hence the term “blockchain.” Essentially, it’s a record that functions like an ever-running receipt. Everyone who uses cryptocurrency has the exact same “receipt” that updates in real time, as transactions occur.

Blockchain plays a central role in maintaining a secure transaction record without the need for a trusted third party. All transactions can be transparently viewed, and anyone in the chain can see them occurring. All records are encrypted, so users maintain anonymity even though the record is fully transparent.

Cryptocurrency Mining Made Simple

Cryptocurrency mining virtualizes what was once a material process – producing real dollars and cents. Now, millions of computations make up the proverbial pickaxe that produces digital money. Millions of computations take up the virtual pickaxe to “find” cryptocurrency. Miners and validators approve blockchain transactions using computing power and are in turn rewarded with cryptocurrency.

There are two widely used cryptocurrency consensus mechanisms employed to verify transactions, add new blocks to the blockchain and create tokens:

- Proof of Work (used by Bitcoin): Requires virtual miners around the world to race to solve a complex mathematical problem. The miner who first solves the puzzle can update the blockchain and receive digital currency. This system requires high-powered computers and a large amount of processing power.

- Proof of Stake (used by Ethereum): Employs a network of validators who “stake” their own cryptocurrency for a chance to validate the next transaction and update the blockchain. Like proof of work, the validator is rewarded with digital currency, but it is distributed to match the validator’s stake. This process maximizes speed and efficiency.

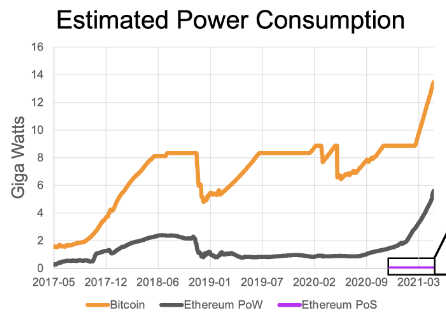

Of course, there’s a lot more to this process. Much more. The primary difference, though, between these methods is energy consumption. Proof of work utilizes significantly more energy because it duplicates solving efforts through competition, whereas proof of stake validators are chosen randomly to solve the puzzle.

Cryptocurrency’s Energy Consumption

Regardless of the method, crypto mining currently consumes between 120 to 240 billion kWh of energy per year, roughly between 0.40 – 0.90% of the world’s electricity usage.3 Proof-of-work schemes are the dominant cause of this massive energy consumption. However, in late 2022, Ethereum completed its merge toward a proof of stake method and estimates it will use 99.95% less energy after the switch.4

The rapid growth of global cryptocurrency has caused electricity usage to balloon year-over-year. Some estimates show it doubling or quadrupling annually. The effects of this ever-evolving industry could have significant impacts to the energy grid, greenhouse gas emission and noise pollution. Because of this, China (and eight other countries) banned crypto mining last year, sending much of its production to other countries throughout the world.

The data center industry has led the charge on sustainability practices by working closely with utilities to adopt and provision renewable energy sources. Additionally, they have taken sophisticated steps in improving their power and cooling methods to operate more efficiently while decreasing costs and improving uptime.

Mining requires highly specialized, high-performance hardware to solve mathematical problems quickly, accurately and efficiently. And the demand for this equipment and space increases each day. Facilities designed and built to run mining operations must offer some of the most efficient cooling and dense rack architecture to manage the computing power required by crypto mining.

A computation- and energy-intense industry, there’s no doubt that cryptocurrency has transformed modern money markets and banking as we know it today. It will be around for a while and will continue to evolve – hopefully more sustainably. That’s something we can reckon with.