Where Is the Fintech Industry Headed?

According to fintech provider Broadridge, more than half of C-level executives in financial services firms agree that digital transformation is currently the most important strategic initiative for their company. They now spend around 27% of their overall IT budget on digital transformation initiatives, compared to only 11% in 2022.1

Why increase investment in financial services digital transformation, which includes partnering with colocation data centers? The answer is that they are seeing improved operational efficiencies and, arguably more importantly, are able to provide richer customer experiences (CX). Better CX equates to happy, loyal customers, and makes the companies “magnets” for providers that offer complementary services or solutions.

Financial services enterprise decision-makers pay attention to industry trends. That helps road test an IT strategy in light of business goals, infrastructure requirements and CX objectives. Let’s touch on three trends that influence the design/delivery of financial services and CX, as well as the hybrid IT infrastructure that can prepare you for the future.

Trends to Consider as You Make FinTech Decisions

The use of artificial intelligence (AI)/machine learning (ML) and mobile apps in financial services are timely. You can find a great deal of information using, ironically, search tools powered by AI and ML. With that in mind, we decided to turn attention to other technology trends that are influencing the financial services industry.

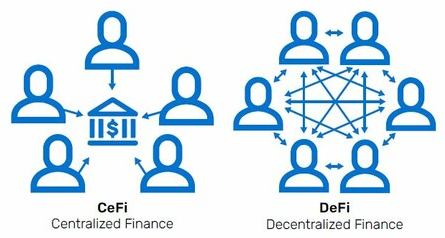

- Decentralized finance (DeFi) – DeFi is an alternative financial system that works on blockchain. It’s designed to remove the “middleman” – the traditional, centralized banking system. Use cases include payment solutions, peer-to-peer lending, digital asset management and digital identities. Financial transactions involve digital exchanges, cryptocurrency, digital wallets and smart contracts. Users can expect to benefit from attractive interest rates and low fees compared to mainstream offers.

- Embedded finance – This trend involves financial products or services that are integrated into the offerings of non-financial third parties or platforms not hosted by financial institutions. This isn’t a new concept – people finance their new vehicle purchases right at the dealership – and many third parties offer payment solutions. But embedded finance is gaining momentum. Some companies, including the American Automobile Association (AAA), are ambitiously offering full-service banking.

Banks that invest in embedded finance initiatives expect to improve overall CX and create revenue while lowering the cost of new customer acquisition and retention. McKinsey says embedded finance reached $20 billion in revenues in the U.S. in 2021 and estimates that the market could double in size within three to five years.3 The article goes on to stress the importance of differentiation in product breadth or depth.

- Cloud adoption – Cloud-based services can deliver low latency and a lot more. Some financial services decision-makers, however, are cautious about migrating to public cloud and colocation data centers. Their reticence often reflects legacy beliefs about data protection, the role of cloud and other concerns. Research, however, shows that times have changed, and that a multicloud strategy can deliver benefits including advanced security, cost reduction, scalability and go-to-market speed.

Gartner’s list of top priorities for the banking and investment industry include growth, digital transformation and consumer/user experience. Gartner research puts distributed cloud (85%) second only to AI/ML (95%) on the list of 10 technologies most likely to be implemented by 2025.3

We’ve developed a white paper that discusses these trends, related research, challenges and opportunities: Financial Services Industry Trends: Data Centers Enable Next-Gen FinTech Customer Experiences.

Hybrid IT Continues to Deliver Business Outcomes

As financial services decision-makers tackle digital transformation, they are exploring technology integration, geographic expansion, new services and cloud’s role. And they’re increasingly turning to colocation data centers for guidance to solve interconnection challenges and accelerate digital transformation.

CoreSite experts welcome the opportunity to share our expertise as we work together to develop a strategy that eases your firm into the future. Our customized hybrid IT solutions and modern, compliant data centers offer 100% service level agreement (SLA) uptime while helping you lower cost, scale dynamically, manage risk and reach new markets easily through interconnection.